Funding for Early-Stage Companies in KC: Top 5 Takeaways from the Sandbox Investor Event

We spent the final day of Summer in the Sand at the Sprint Accelerator with some of the key players and connectors in early-stage funding in the Kansas City region.

Led by Melissa Roberts from the Enterprise Center in Johnson County and Rebecca Gubbels from Digital Sandbox KC, the discussion was full of valuable information. Attendees heard from Beth Engel of Dundee Venture Capital, Keith Harrington of Novel Growth Partners, Imagene Harris of NetWork Kansas, Kate Hodel of KCSourceLink’s CapitalMatch program and Jill Meyer of the UMKC Small Business & Technology Development Center.

Here are the top five nuggets of knowledge that we learned about investors and startup funding in KC:

BE COMMITTED TO YOUR VISION BUT NOT THE PATH.

Funders want to work with passionate entrepreneurs. But they also want to see that you are genuinely open to feedback.

“The product will change,” said Engel. “I need to know why you, in particular, care about the solution.”

Show investors from day one that you are willing to listen and consider new ideas for how to launch and grow your business. It’s something we like to call “coachability,” and it matters.

BE PATIENT AND REMEMBER, INVESTORS ARE PEOPLE, TOO.

An investment is a relationship between your business and its funders. If you’re lucky, the relationship builds to equity in your company. But like any relationship, it takes time to develop and requires patience.

“Investors are working within their own systems and processes,” said Harris. “Those systems and processes aren’t perfect.”

Have faith in the process and the people.

DO YOUR HOMEWORK.

“Fundraising can be a long, long road,” said Harrington. “Start by finding out who the right funder could be.”

Investment groups have varying interests, criteria and terms. Some equity investments are time-bound and require an exit strategy. Some funders have a narrow focus, both in terms of concept and location.

Hint: There’s a cheat sheet. The Funding Your Business guide from KCSourceLink walks you through different options and who can help you secure funding for your business.

GET CONNECTED TO PEOPLE AND RESOURCES.

Being connected to the entrepreneurial community is a great way to show that you’ve done your homework and you’re open to feedback.

“The first question I’m going to ask is, ‘Who are you working with?’” said Harris.

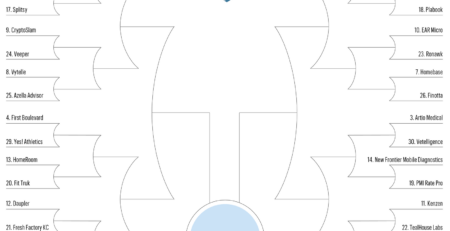

Seventy percent of companies that got funding in 2017 received assistance from their network of resources, according to research from KCSourceLink. Take advantage of networking events, business classes and mentoring programs in KC. The knowledge and connections you gain will pay off, especially when you’re ready to raise capital for your startup.

AN EQUITY INVESTMENT MIGHT NOT BE THE BEST FIT.

Before you approach a potential investor, ask yourself if a capital investment is right for you and your business.

If you aren’t ready to exchange a portion of your company’s ownership for an investment or if you’re hesitant to divert from your plan for your company’s growth, there are other funding options. Small Business Innovation Research (SBIR) grants and programs like Digital Sandbox KC, AltCap, Justine PETERSEN and others offer funding to early-stage businesses in KC without taking ownership.

Ready for more insights from the Sandbox?

Sign up for our monthly newsletter. It’s a great way to stay in the know about KC startup topics and events and hear what’s happening with companies in the Sandbox.